A 24 month waiver can only be granted once every two years. Then, select if you would like to be considered for a 24 month waiver by clicking Yes or No.

If you need to add more than one location, click in the blank row below the last added location.

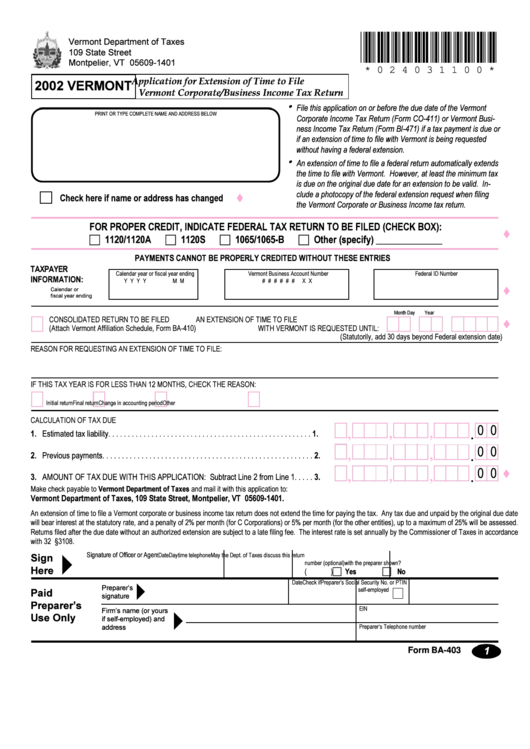

How to file extension for business tax return code#

You can either type in the name of the jurisdiction or the location code to filter and select a location. Click the Add Locations button to add local city or county use tax jurisdictions.The total Local Sales Taxable Amount must equal the total Retail Sales Taxable Amount. Once you have your locations listed, enter your retail sales Taxable Amount for each location.

Click the Add Locations button to add local city or county sales tax jurisdictions.Once all income, deductions, and credits are entered, click Next.Select the credit type and enter the amount. If you have Sales and Use Credits, click the Add/Delete Credits button.If applicable, enter the gross amount subject to Use Tax in the Gross Amount field.Select the deduction type and enter the amount. If you have additional deductions, click the Add Deduction button.The Retail Sales Gross Amount and applicable deductions have carried forward from the Business & Occupation page.Once all income, deductions, and credits are entered click Next.If you have additional credits, click the Add/Delete Credits button.If your business qualifies for the Small Business Credit, it will automatically calculate based on the value entered for the Gross Amount.If you have deductions, click the Add Deduction button.

For each tax classification, enter your gross sales in the Gross Amount field.More information on tax classifications for common business activities. If you want to add or delete any previously selected tax classifications, click the Add/Delete Tax Classifications button. Review and select tax classifications.If you want to upload a file, select Upload a File.If you have no business activity to report in this filing period, select Report No Business.If you have more than one return to file, the Excise Tax Outstanding Returns panel will display, click View Returns and click File Return next to the return you want to file. In the Excise Tax Return panel, click the File Return link.On the My DOR Services page, click Get Started.If asked, complete the Multi-Factor Authentication challenge to verify your identity. Log in by entering your SAW User ID and Password, then click Log In.

0 kommentar(er)

0 kommentar(er)